Wind & Hail Insurance in North Carolina: Compare Coverage & Costs

North Carolina homeowners face unique challenges when it comes to wind and hail damage. From hurricanes along the Outer Banks to severe inland hailstorms, standard homeowners insurance often excludes or limits coverage for wind-related events.

At Harbor Insurance Agency, we help you find the right wind & hail insurance—whether through the North Carolina Insurance Underwriting Association (NCIUA) or private market carriers that may offer lower premiums and better coverage options.

👉 Looking for general wind & hail insurance information? Visit our Wind & Hail Insurance page to explore coverage beyond North Carolina.

If you’re searching for the most affordable wind & hail insurance in NC, we can compare multiple providers to help protect your home at the best rate.

Common Wind & Hail Insurance Claims in NC

Every year, homeowners across North Carolina’s coastal and inland regions face costly damage due to wind-related weather events. Some of the most common wind & hail insurance claims include:

- Hurricane Damage – Roof damage, fallen trees, and siding destruction from strong winds

- Tornadoes & Windstorms – Broken windows, structural damage, and flying debris

- Hail Damage – Impact damage to roofs, gutters, siding, and outdoor structures

- Wind-Driven Rain – Water intrusion through damaged exteriors

A dedicated wind & hail insurance policy ensures full protection against these risks, so you’re not left paying out of pocket after a storm.

📝 Want to learn more? Check out our blog post on how to prepare your home for hurricane season.

How Your Roof’s Age & Materials Affect Your Insurance Rate

Did you know your roof’s age and materials play a significant role in wind & hail insurance costs? Insurers assess risk based on:

✔ Age of the Roof – Older roofs often lead to higher premiums due to increased vulnerability

✔ Type of Roofing Material – Impact-resistant shingles, metal, or fortified roofing can qualify for lower rates

✔ Condition of the Roof – Homes with well-maintained or upgraded roofs may receive discounts

Upgrading to storm-resistant materials can help reduce your premium while improving your home’s protection.

💡 Does homeowners insurance cover roof damage from hail? Find out in our blog post on hail damage and insurance.

NC Wind & Hail Insurance and the NCIUA Coastal Counties

For homeowners in North Carolina’s coastal region, securing the right wind & hail insurance is essential. Standard homeowners policies often exclude or limit coverage for damage caused by hurricanes, strong winds, and hail, leaving many properties exposed to financial risk.

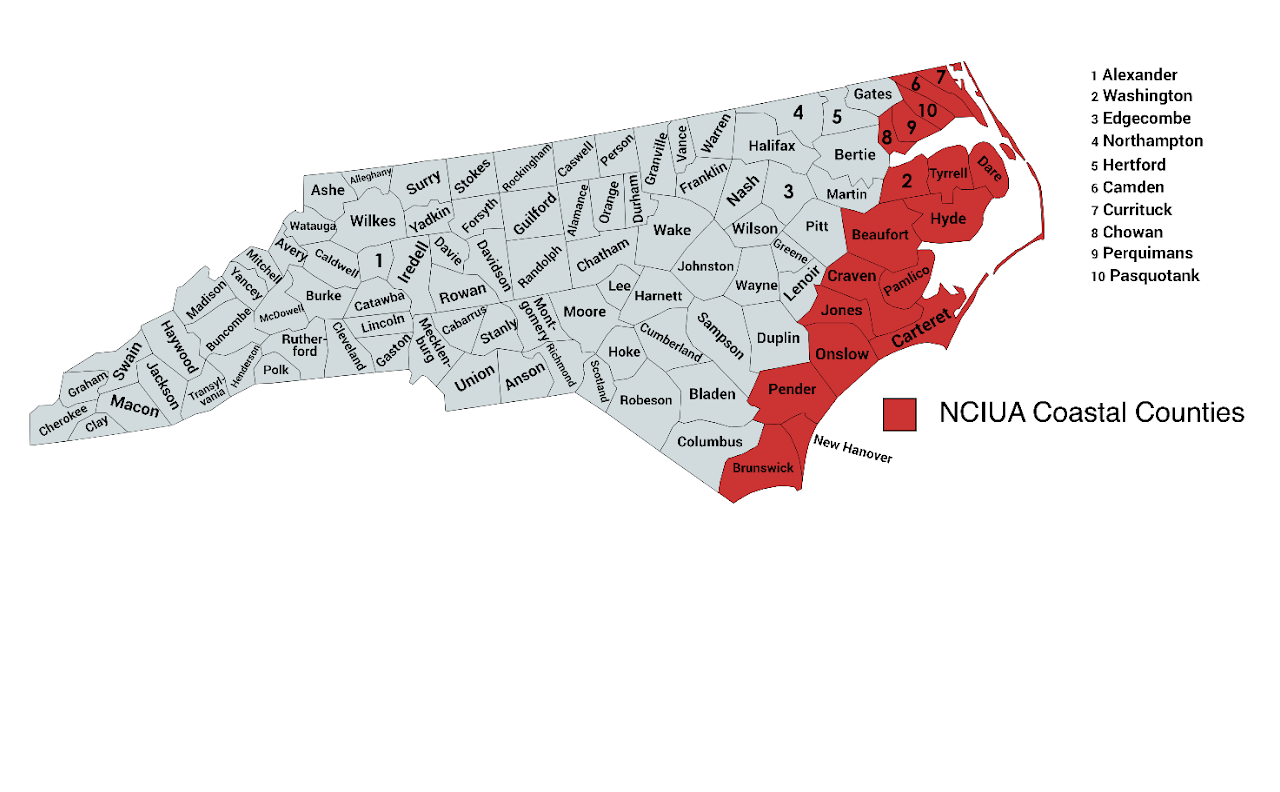

One option available is coverage through the North Carolina Insurance Underwriting Association (NCIUA), also known as the Coastal Property Insurance Pool (CPIP). This state-regulated program provides wind and hail insurance for properties in 18 designated coastal counties where private insurers may not offer sufficient coverage.

Which Counties Qualify for NCIUA Wind & Hail Insurance?

If your home is located in one of the following counties, you may be eligible for NCIUA wind & hail insurance:

- Beaufort, Brunswick, Camden, Carteret, Chowan, Craven, Currituck, Dare, Hyde, Jones, New Hanover, Onslow, Pamlico, Pasquotank, Pender, Perquimans, Tyrrell, and Washington County

NC Wind and Hail Insurance Map

While NCIUA is an option, it is considered the “Market of Last Resort.” That means homeowners should explore private market options first, as private insurers may provide:

- Lower premiums compared to NCIUA

- Higher coverage limits

- More flexible policy options

At Harbor Insurance Agency, we’ll compare NCIUA coverage vs. private market policies to help you find the best protection for your home—whether you need a stand-alone wind & hail policy or a bundled homeowners plan. Contact us today to explore your options!

Hurricane Insurance vs. Wind & Hail Insurance: What’s the Difference?

Many homeowners ask, "Is hurricane insurance the same as wind & hail insurance?" The answer is no—these coverages are not identical.

- Wind & Hail Insurance – Covers wind-related damage from hurricanes, tornadoes, and storms

- Hurricane Insurance – Often refers to a hurricane deductible within a homeowners policy but does not always cover hail damage

If you’re not sure what coverage you need, our agents will help you find the best policy based on your home’s location and risk factors.

How Much Is Wind & Hail Insurance in NC?

The cost of wind & hail insurance varies based on:

- Location – Coastal homes typically have higher premiums than inland properties

- Home Construction – Homes with impact-resistant roofs may qualify for lower rates

- Deductibles – A higher deductible can reduce your monthly premium

- Carrier Selection – Private insurers may offer lower rates than NCIUA

📌 Looking for more ways to save? Bundling wind & hail coverage with your home insurance or car insurance could help lower your premium.

At Harbor Insurance Agency, we compare multiple carriers to help you find the cheapest wind & hail insurance in NC—without sacrificing coverage.

Frequently Asked Questions (FAQ)

Do I need a stand-alone wind policy if I have homeowners insurance?

Some NC homeowners policies exclude wind coverage, requiring a separate wind & hail policy for full protection.

Is wind & hail insurance required in NC?

While not required by state law, many mortgage lenders require wind coverage for homes in high-risk coastal zones.

Can I see the NC wind and hail insurance map before choosing a policy?

Yes! We’ll review the official NCIUA map and explain which coverage options apply to your home.

How much is wind & hail insurance in NC if I live inland?

Inland homes typically have lower rates than coastal properties, but hailstorms still pose a risk. Normally it will be included with an inland homeowners policy and does not require a separate policy.

Does wind & hail insurance cover flooding or storm surge?

No, wind & hail insurance does not cover flood damage. If your home is in a coastal or flood-prone area, you will need a separate flood insurance policy to protect against rising water, storm surge, and flash flooding.

👉 Learn more about Flood Insurance in North Carolina.

Is flood insurance required in NC?

Flood insurance is not required by North Carolina law, but it may be required by your mortgage lender if your home is in a FEMA-designated high-risk flood zone. Even if it’s not required, many homeowners opt for flood insurance to protect against costly water damage from hurricanes and heavy rain.

Can I bundle wind & hail insurance with flood insurance?

Yes! While wind & hail insurance and flood insurance are separate policies, Harbor Insurance Agency can help you bundle them with our agency for complete protection. This ensures your home is covered for both wind-related damage and rising water from hurricanes and heavy storms.

📌 Want to learn more? Get details on our Flood Insurance options here.

Request a Wind & Hail Insurance Quote from Harbor Insurance Agency

Don’t wait until the next storm—protect your home today. Whether you need NCIUA wind & hail insurance or prefer a private market policy, Harbor Insurance Agency will help you find the best coverage at the lowest rate.

✔ Compare NCIUA vs. private insurers

✔ Find the most affordable wind & hail insurance in NC

✔ Ensure your home is fully protected